Print

Newcomers to Canada (immigrants)

5-31-2016

If you left another country to settle in Canada, the following information will introduce you to the Canadian tax system and help you to complete your first income tax and benefit return as a resident of Canada.

It applies only for the first tax year that you are a new resident of Canada for income tax purposes. After your first tax year in Canada, you are no longer considered a newcomer for income tax purposes.

When should you apply to receive benefits and credits?

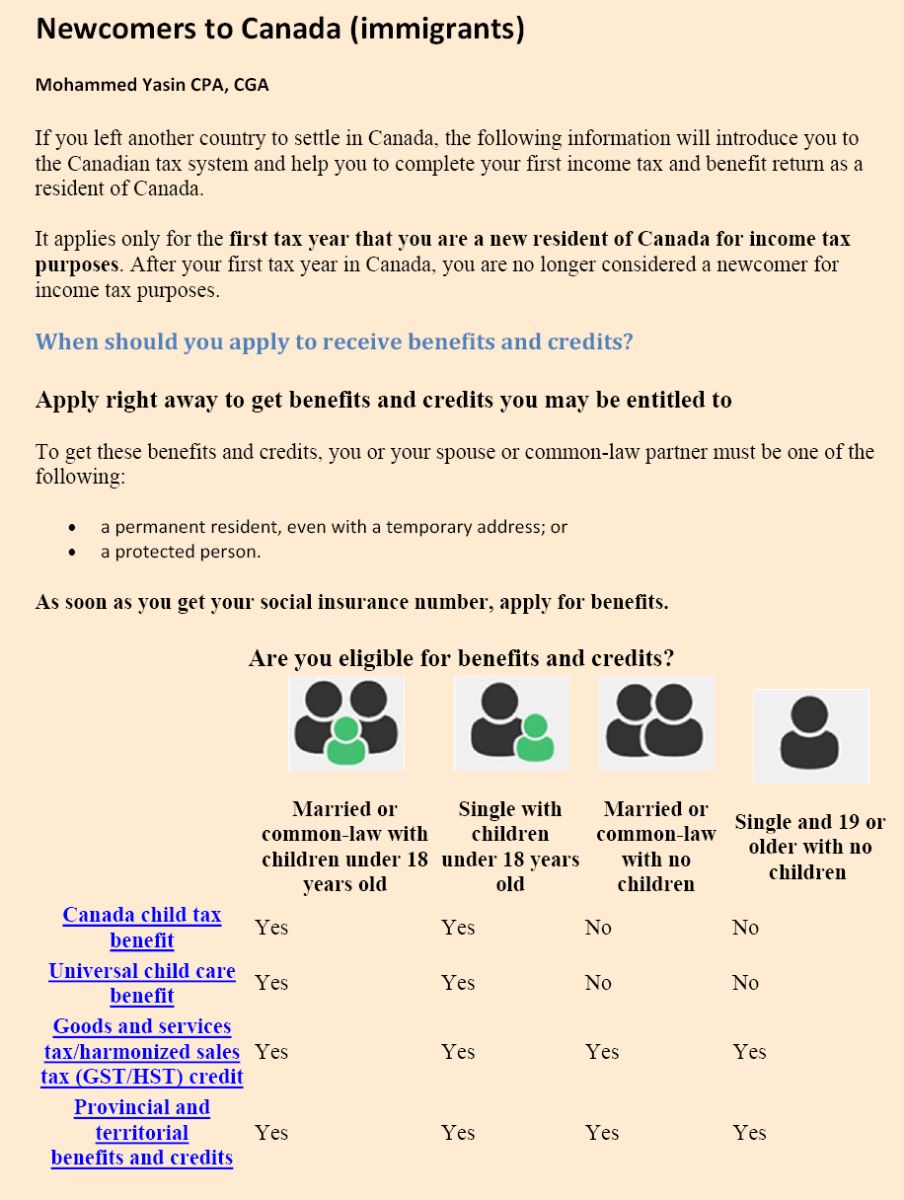

Apply right away to get benefits and credits you may be entitled to.

To get these benefits and credits, you or your spouse or common-law partner must be one of the following:

• a permanent resident, even with a temporary address; or

• a protected person.

As soon as you get your social insurance number, apply for benefits.

How to apply for benefits and credits

To apply for both the Canada child tax benefit and the universal child care benefit and to register your child or children for the GST/HST credit, fill out and send the following two forms to the Canada Revenue Agency (CRA):

• RC66, Canada child benefits application

• RC66SCH, Status in Canada/Statement of Income

To apply for the GST/HST credit for you or your spouse or common-law partner, fill out Form RC151, GST/HST Credit Application for Individuals Who Become Residents of Canada for the year that you became a resident of Canada..

Include the following information with your application:

• Record of Landing or confirmation of permanent residence issued by Citizenship and Immigration Canada;

• Citizenship certificate;

• Notice of Decision or a Temporary resident’s permit issued under the Immigration and Refugee Protection Act;

• valid temporary or permanent mailing address;

• a void cheque if you are applying for direct deposit; and

• proof of birth for your children who were born outside Canada.

After you apply for benefits and credits

You don’t have to apply for the benefits and credits every year. But every year you must:

• file your income tax and benefit return

o to continue receiving the benefit and credit payments that you are entitled to, you have to file your income tax and benefit return on time every year, even if you have no income in the year. If you have a spouse or common-law partner, they also have to file a return every year.

• keep your personal information up to date

o to make sure you are getting the right amount of benefits and credits, you must keep your personal information updated with the CRA.

• keep your supporting documents in case we ask for them

o in the future, you may receive a letter from the CRA might as part of the validation process, asking you to confirm your personal information.

Footnotes:

|